Understanding the Escrow Process for the State of California

What is Escrow?

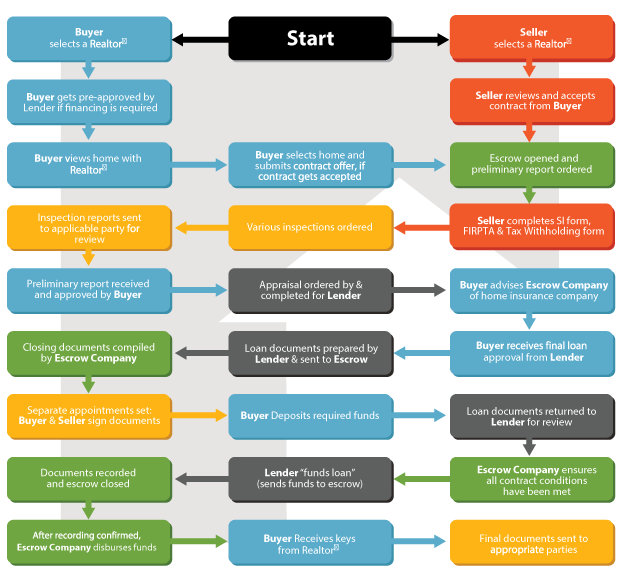

Buying or selling a home (or other piece of real property) usually involves the transfer of large sums of money. It is imperative that the transfer of these funds and related documents from one party to another be handled in a neutral, secure and knowledgeable manner. For the protection of buyer, seller and lender, the escrow process was developed.

As a buyer or seller, you want to be certain all conditions of sale have been met before property and money change hands. The technical definition of an escrow is a transaction where one party engaged in the sale, transfer or lease of real or personal property with another person delivers a written instrument, money or other items of value to a neutral third person, called an escrow agent or escrow holder. This third person holds the money or items for disbursement upon the happening of a specified event or the performance of a specified condition.

Understanding Statement of Information

What’s New?

According to the New California Residential Purchase Agreement released on April 28, 2010, all Sellers of a Residential Property shall provide the escrow holder completed Statement of Information within 7 days after acceptance of contract.

Understanding Statement of Information

What’s in a name? When a title company seeks to uncover matters aecting title to real property, the answer is, “Quite a bit.” Statement of Information provide title companies with the information they need to distinguish the buyers and sellers of real property from others with similar names. After identifying the true buyers and sellers, title companies may disregard the judgments, liens or other matters on the public records under similar names. To help you better understand this sensitive subject, the California Land Title Association has answered some of the questions most commonly asked about Statements of Information.

What is a Statement of Information?

A Statement of Information is a form routinely requested from the buyer, seller and borrower in a transaction where title insurance is sought. The completed form provides the title company with information needed to adequately examine documents so as to disregard matters which do not aect the property to be insured, matters which actually apply to some other person.

What does a Statement of Information do?

Every day documents aecting real property liens, court decrees, bankruptcies are recorded. Whenever a title company uncovers a recorded document in which the name is the same or similar to that of the buyer, seller or borrower in a title transaction, the title company must ask, “Does this document aect the parties we are insuring?” Because, if it does, it aects title to the property and would, therefore, be listed as an exception from coverage under the title policy. A properly completed Statement of Information will allow the title company to dierentiate between parties with the same or similar names when searching documents recorded by name. This protects all parties involved and allows the title company to competently carry out its duties without unnecessary delay.

What types of information are requested in a Statement of Information?

The information requested is personal in nature, but not unnecessarily so. The information requested is essential to avoid delays in closing the transaction. You, and if applicable, your spouse or registered domestic partner, will be asked to provide full name, social security number, year of birth, birthplace, and information or citizenship. If applicable, you will be asked the date and place of your marriage or registered domestic partnership. Residence and employment information will be requested, as will information regarding previous marriages or registered domestic partnerships.

Will the information I supply be kept condential?

The information you supply is completely condential and only for title company use in completing the search of records necessary before a policy of title insurance can be issued.

What happens if a buyer, seller or borrower fails to provide the requested Statement of Information?

At best, failure to provide the requested Statement of Information will hinder the search and examination capabilities of the title company, causing delay in the production of your title policy. At worst, failure to provide the information requested could prohibit the close of your escrow. Without a Statement of Information,it would be necessary for the title company to list as exceptions from coverage judgments, liens or other matters which may aect the property to be insured. Such exceptions would be unacceptable to most lenders, whose interest must also be insured.

CONCLUSION:

Title companies make every attempt in issuing a policy of title insurance to identify known risks acting your property and to eciently and correctly transfer title to protect your interests as a homebuyer. By properly completing a Statement of Information, you allow the title company to provide the service you need with the assurance of condentiality.

Who Pays What – A Guide to Closing Costs

The SELLER can generally be expected to pay for:

• Real Estate commission

• Documentation preparation fee for deed

• Documentary transfer tax, if any

• Any city transfer/conveyance tax (according to contract)

• Payoff of all loans in Seller’s name

• Interest accrued to lender being paid off

• Statement fees, reconveyance fees and any prepayment penalties

• Termite inspection (according to contract)

• Termite work (according to contract)

• Home warranty (according to contract)

• Any judgments, tax liens, etc., against the Seller

• Tax proration (for any taxes unpaid at time of transfer of title)

• Any unpaid homeowner’s dues

• Recording charges to clear all documents of record against Seller

• Any bonds or assessments (according to contract)

• Any and all delinquent taxes

• Notary fees

• Homeowner’s transfer fee

• City transfer/conveyance tax (according to contract)

The BUYER can generally be expected to pay for:

• Title insurance premium for Lender’s policy

• Escrow fee

• Document preparation (if applicable)

• Notary fees

• Recording charges for all documents in Buyer’s name

• Termite inspection (according to contract)

• Tax proration (from date of acquisition)

• All new loan charges (except those required by Lender for Seller to pay)

• Interest on new loan from date of funding to 30 days prior to first payment date

• Assumption/change of records fees for takeover of existing loan

• Beneficiary statement fee for assumption of existing loan

• Inspection fees (roofing, property inspection, geological, etc.)

• Home Warranty (according to contract)

• Fire insurance premium for first year

• Title insurance premium for Owner’s policy

YOURS or THEIRS – The Personal vs. Real Property Dilemma

The distinction between personal property and real property can be the source of difficulties in real estate transaction. A purchase contract is normally written to include all real property, that is, all aspects of the property that are fastened down or an integral part of the structure. For example, this would include light fixtures, drapery rods, attached mirrors, trees and shrubs in the ground. It would not include potted plants, free- standing refrigerators, washer/dryers, microwaves, bookcases, swag lamps, etc. If there is any uncertainty whether an item is included in the sale or not, it is best to be sure that the particular item is mentioned in the purchase agreement as being included or excluded.

Your Appointment BUYER:

Below is a list of items that you will need before your appointment to sign the escrow papers…

Identication

There are several acceptable forms of identication, which may be used during the escrow process. These include:

• A current driver’s license

• Passport

• State of California Department of Motor Vehicles ID card

One of these forms of identication must be presented at the signing of escrow in order for the signature to be notarized.

Fire & Hazard Insurance

When you are buying a single-family, detached home (and in some cases, a town home), be sure to order your insurance before the loan has been approved. Next, call your escrow officer with the insurance agent’s name and number so that they can make sure the policy complies with your lender’s requirements. You must have the insurance in place before the lender sends money to the title company. If you do not have an insurance agent, your real estate agent can oer some suggestions.

Depositing Funds to Close Escrow

In order to prevent possible delays in the escrow closing, be prepared to deposit into escrow a Cashiers or Certied check cleared through the CA Federal Reserve District 12 or 32 for the amount requested by your escrow officer. Wire instructions will be provided should you prefer to wire transfer funds into escrow.

Lender’s Requirements

Make sure you have satisfied your lender’s requirements before coming to the Title company to sign papers.

Vesting for Title

Decide how you would like to hold title to your new home. You may wish to consult a lawyer, accountant, or other qualified professional before making this decision.

Understanding FIRPTA – Foreign Investment in Real Property Tax Act

The disposition of a U.S. real property interest by a foreign person (the Seller) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign sellers on dispositions of U.S. real property interests.

Foreign Sellers are subject to a 10% withholding of the sales price unless ALL OF THE FOLLOWING EXEMPTIONS are met:

• The buyer acquire the property for use as a home and the amount realized (generally sales price) is not more that $300,000. The buyer or a family member of the buyer must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

• The seller provides a certification stating that the seller is not a foreign person.

• The buyer receives a withholding certificate from the IRS that excuses withholding.

• The Seller provides a written notice that no recognition of any gain or loss on the transfer is required because of a nonrecognition provision in the

Internal Revenue Code or a provision in a U.S. tax treaty. The buyer must file a copy of the notice by the 20th day after the date of transfer with the IRS.

• Seller is a resident alien.

Other Important Facts:

• Foreign citizens doing business and earning income in the United States are required to have taxpayer identification numbers (TINS), this TIN is required for remitting payment to the IRS.

• The IRS rules place the responsibility for withholding potential income tax due in the amount of 10% of the purchase price on the buyer of the real property from a foreign entity. The real property becomes the security for the IRS to ensure that they receive taxes that are due to them. If the payment is not made by the buyer, the IRS can seize the real property (or other assets of the buyer).

Additional information, other exemptions, forms and publications can be found at www.irs.gov, enter “FIRPTA” in the search box.

Understanding Property Taxes in Escrow

1st Installment

Due Date: November 1st

Dessillent Date: December 10, 5 pm

Period Covered: July – December

2nd Installment

Due Date: March 1st

Dessillent Date: April 10, 5 pm

Period Covered: January – June

Paying Property Taxes in an escrow account are among one of the most confusing issues for both Buyers and Borrowers. Whether you are buying a home or refinance your existing mortgage, taxes are applied in several ways in your escrow. Below are a few that you will find often on your escrow instruction:

Taxes to be paid:

Property taxes are generally divided so that the buyer and the seller each pay taxes for the part of the property tax year they owned the home. The fiscal tax year commences on July 1 of each year. and ends on June 30 of the following year.

Tax Impounds:

An Impound Account, also known as an Escrow Impound Account, is an account set up and managed by mortgage lenders to pay property taxes and insurance on behalf of the home buyer. The lender may collect 2-6 months of tax payment with each month’s amount equal to about 1/12 of the total sum of the annual property taxes along with their mortgage payment. When the time comes to pay the annual property taxes, the lender makes the payment from the funds accumulated in the account on behalf of the buyer.

Tax Prorations:

At time of closing, the escrow agent will sometimes required to determine what portion of the next tax installment is the seller’s responsibility, they will then charge the seller and credit the buyer with said amount. When the next installment is due, the buyer will pay the total amount since the buyer was al- ready reimbursed with the seller’s portion at closing. Likewise, if the seller had already prepaid his taxes, the prepaid portion will then be charged to the buyer and serves as credit to the seller.

Supplemental Taxes:

If the market value of property is different from the previous owner’s taxable value, the new owner will receive a NOTICE

OF SUPPLEMENTAL ASSESSMENT and a supplemental tax bill or refund. Usually supplemental taxes are not collected in escrow. Notices of supplemental assessment and supplemental tax bills are mailed several months after escrow closes. Supplemental assessments are pro-rated from the date of transfer to the end of the tax year (June 30th). Changes in ownership that occur between January 1 and May 31 are subject to two supplemental assessments because of the State’s property tax calendar. Supplemental assessments are typically paid by the new owner directly and are not included in impound accounts. Supplemental property tax bills are mailed within 2 weeks of the Notice of Supplemental Assessment. Due dates for supplemental taxes can vary. Please read the tax bill carefully, or contact the TAX COLLECTOR for more information.